Risk is defined by ISO-31000 as “the effect of uncertainty on objectives.” Enterprise risk management is a holistic approach to managing risks that can impact the successful execution of the university’s mission and objectives.

The goal of the UCF enterprise risk management (ERM) program is to provide a systematic approach to identify and manage various types of risk, regardless of the origin. Risks can include those affecting the whole of higher education, risks specific to the UCF, or risks related to certain units and processes. A robust ERM program will benefit UCF by:

Risk Categories

ISO-31000

ISO-31000 is the only international standard on the practice of risk management. The best-practice guidelines provide principles, a framework, and a process for managing risk, which it defines as “the effect of uncertainty on objectives.” The standard is flexible and can be customized to any organization, including public entities and institutions of higher education. The UCF ERM Program is based upon this international standard.

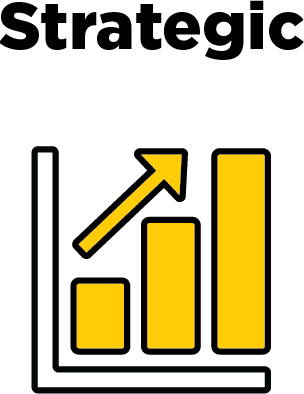

Value Creation and Protection

Integration across the organization, a structured and thorough approach, customization to specific needs, inclusivity, adaptability, reliance on the best information, acknowledgment of human factors, and a focus on continual improvement. Together, these principles ensure a balanced and effective way to create and safeguard value.

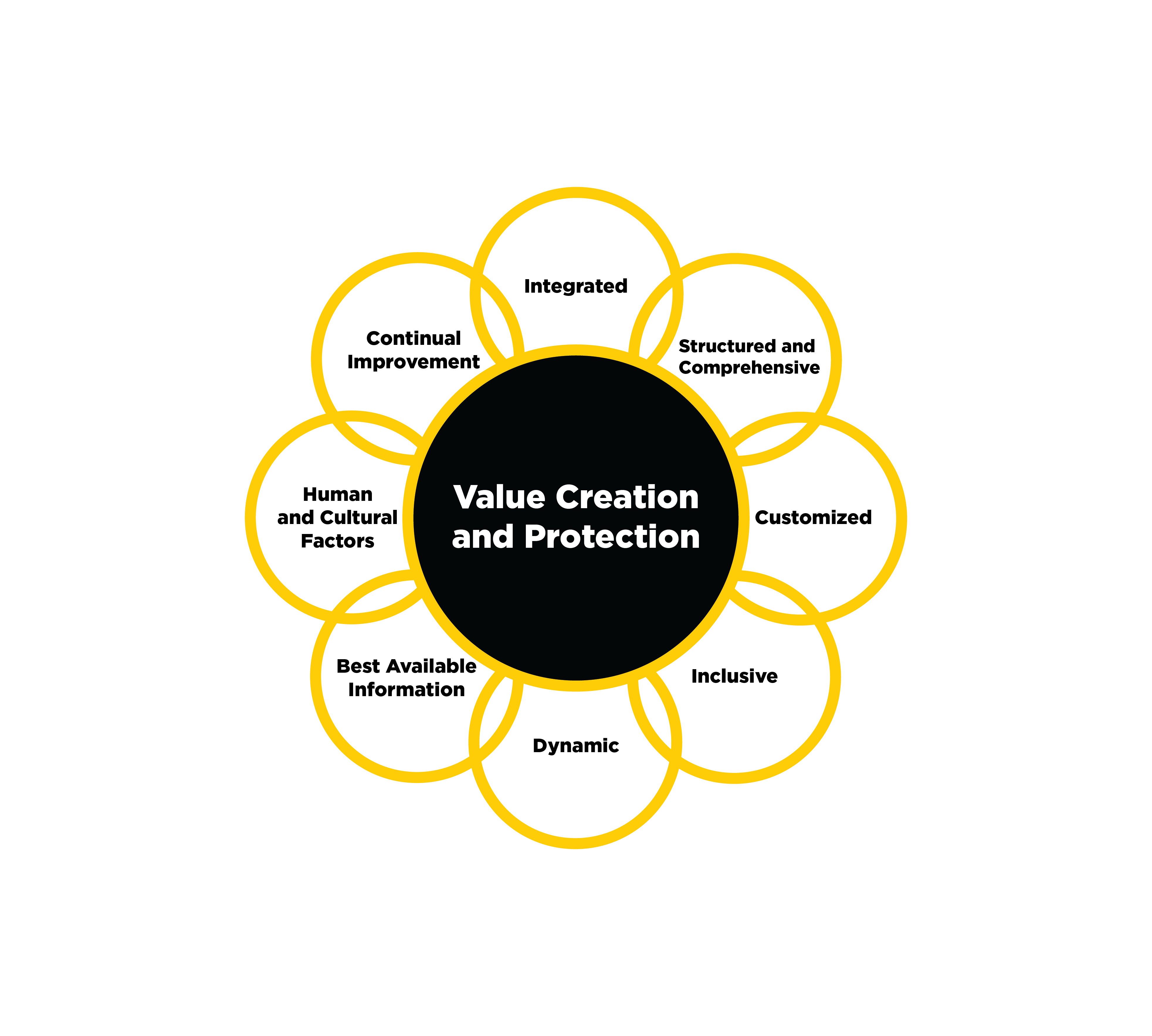

Leadership and Commitment

Integration, Design, Implementation, Evaluation, and Improvement. These elements represent how strong leadership and commitment drive the entire process, ensuring each step is connected and continuously refined for success.

Risk Assessment

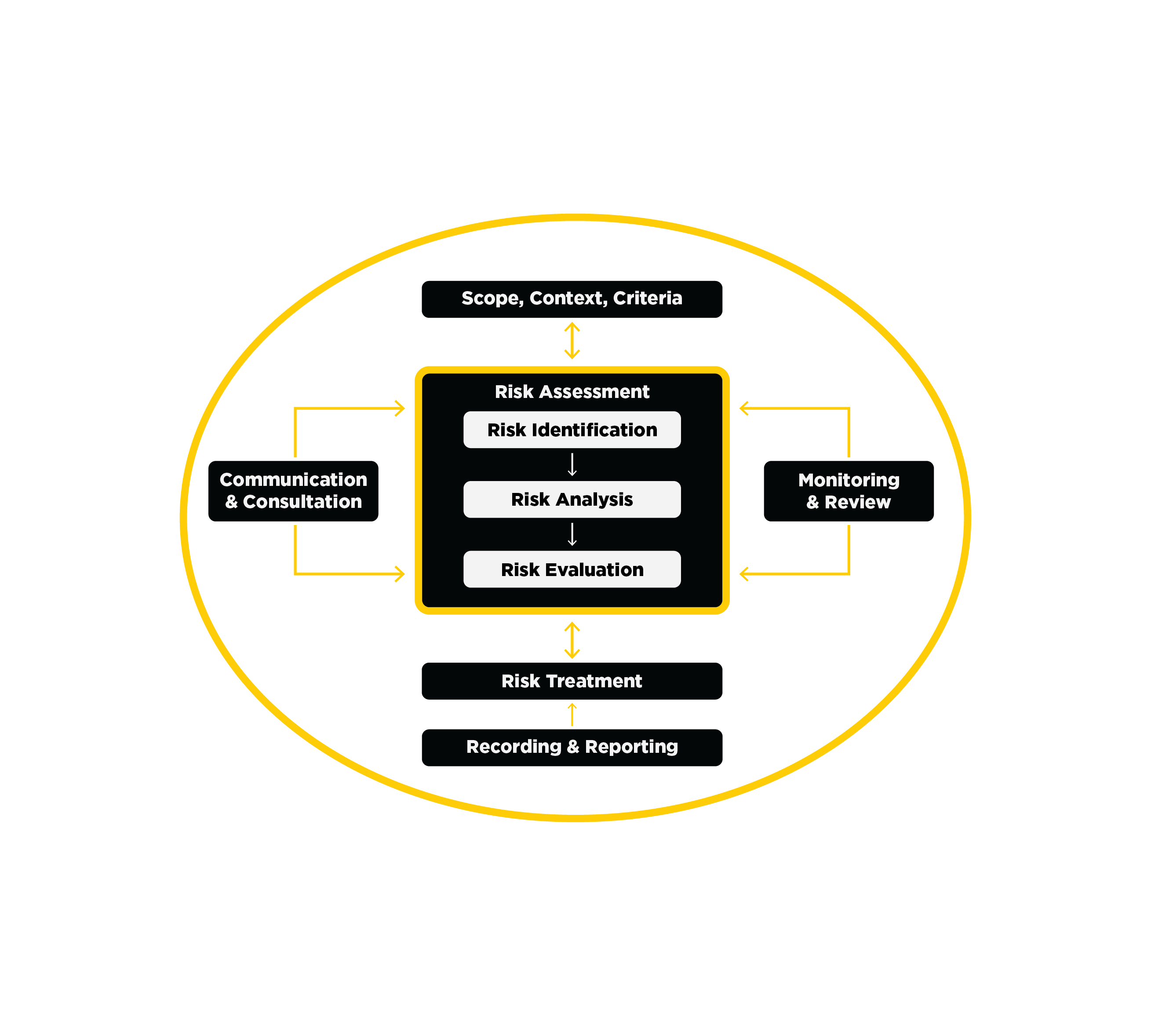

The image shows the process of “Risk Assessment,” with key components in a continuous cycle. At the core, risk assessment involves Risk Identification, Risk Analysis, and Risk Evaluation. Surrounding this are supporting processes: defining the Scope, Context, and Criteria, Communication and Consultation, Monitoring and Review, and Recording and Reporting. Finally, Risk Treatment is applied based on the evaluation, completing the risk management process.